2017 state of hawaii department of taxation renewable energy technologies income tax credit for systems installed and placed in service on or after july 1 2009 note.

Hawaii state solar tax credit form.

Honolulu solar roofs initiative.

State of hawaii department of taxation subject.

2017 64 pages 593 kb 1 10 2018.

Both the us federal government and the state of hawaii offer tax incentives to homeowners looking to switch to solar.

This webpage offers examples of the variety of local state and federal incentives designed to encourage the growth and proliferation of renewable energy technologies.

Check with your tax professional on the specifics of your project regarding this incentive.

Outline of the hawaii tax system as of july 1 2019 4 pages 59 kb 2 26 2020.

Booklet a employer s tax guide rev.

Contact the appropriate regulatory agency for more information.

Local solar hot water incentives.

As we ve discussed on the hawaii solar incentives page here at hawaiisolarhq the tax credit in the aloha state is 35 of the cost of the solar installation or 5 000 whichever is less.

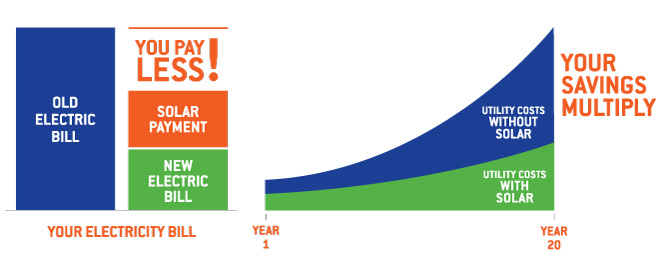

While buying a solar system outright will make you directly eligible for hawaii s solar tax credits and incentives you also have the option to lease your system from as little as 0 down our flexible leasing options pass down solar incentives in the form of a low predictable monthly.

References to married and spouse are also references to in a civil union and civil union partner.

Not bad just for putting up solar panels.

2012 01 pdf temporary administrative rules relating to the renewable energy technologies income tax credit retitc.

Thanks to the hawaii solar tax credit you still can.

3 enterprise zone tax credit attach form n 756.

Solar wind total amount of renewable energy technologies income tax credit for systems installed and placed.

Tax information release no.

State solar hot water incentives.

As a result going green not only comes with myriad perks but if you hurry and invest in a new pv system for your home you could still shave off as much as 60 of the.

Forms 2019 fillable.

What is the solar tax credit in hawaii.

The state of hawaii offers a personal tax credit of 35 of the cost of the system or 2 250 whichever is less as well as a one time 750 rebate for existing homes not available for homes built after 2009.

Go solar your way with sunrun.

Form n 342 2019 renewable energy technologies income tax credit for systems installed and placed in service on or after july 1 2009 author state of hawaii department of taxation.

Retitc forms shortcut to form n 342 and instructions form n 342a form n 342b and instructions and form n 342c and instructions.

Schedule cr rev 2019 schedule of tax credits author.

At sunrun we understand that everyone s financial situation is different.

State of hawaii incentives 1 hawaii renewable energy technologies.

A summary of state taxes including information on tax rates forms that must be filed and when taxes must be paid.